Which Item Is An Auditor Least Likely To Review During A System Controls Audit?

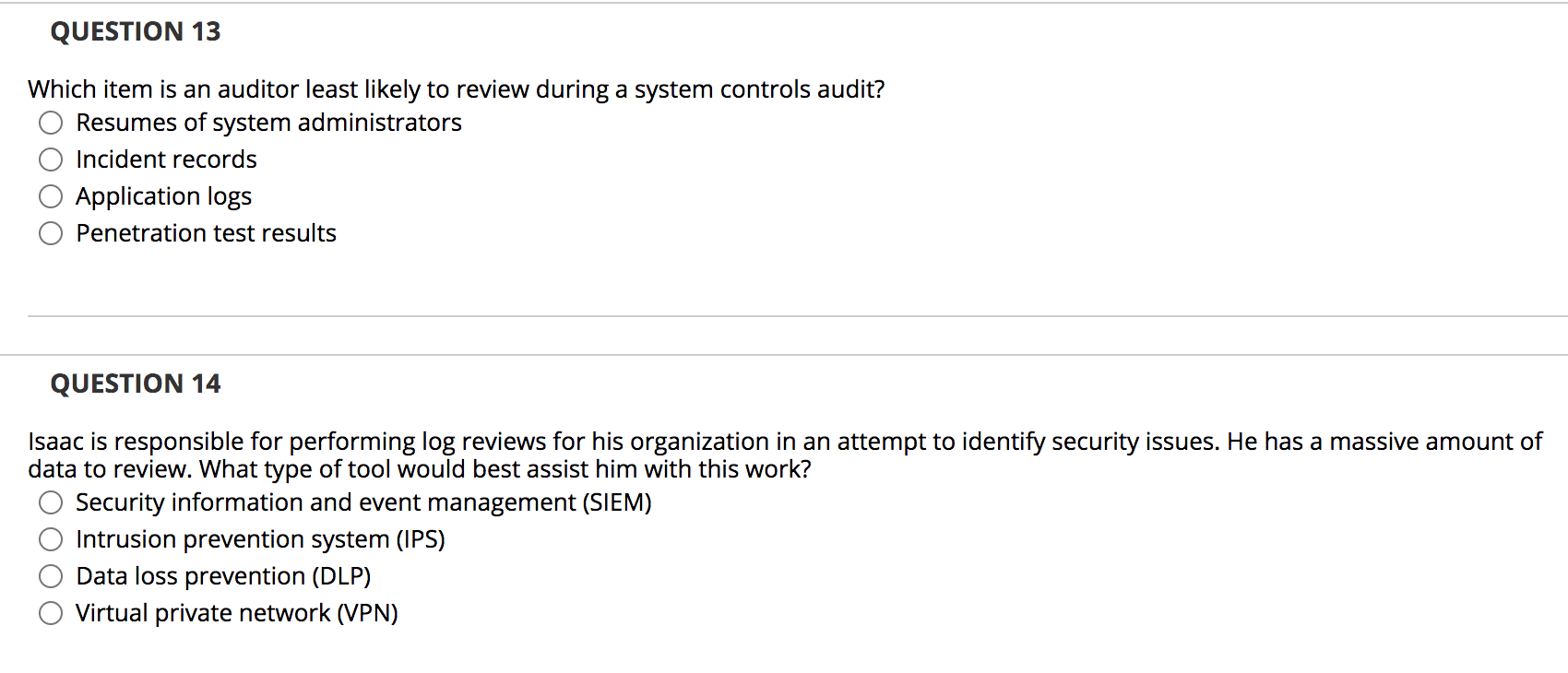

Which item is an auditor least likely to review during a system controls audit?. The audit of controls over reprogramming andor redirection of PEPFAR funds for COVID19 will be a collaborative audit conducted by HHS-OIG and the US. The agenda for conversations between the auditor and the audit committee could among other things highlight 1 assessment of the design or operating effectiveness of controls. The monitoring report should have an appropriate level of information to be.

AuditsIndependent Review - An audit or independent review should be performed for this activity. A review of interim financial statements of a public company consists of analytical procedures and inquiries. Each OIG will issue a separate report.

Public company you can find a wealth of information in the companys annual reports on Form 10-K and quarterly reports on Form 10-QAmong other things the 10-K and 10-Q offer a detailed picture of a companys business the risks it faces and the operating and financial results for the fiscal year or quarter as applicable. 4 use of and reliance on the work of others. If the auditor is unable to apply the designed audit procedures or suitable alternative procedures to a selected item I.

KPMG International Limited or simply KPMG is a British-Dutch multinational professional services network and one of the Big Four accounting organizations. However the auditor may still include the item if it is subsequently determined that. This revision reflects the foundational shift outlined in the Presidents Management Agenda PMA to set the stage for enhanced result-oriented accountability for.

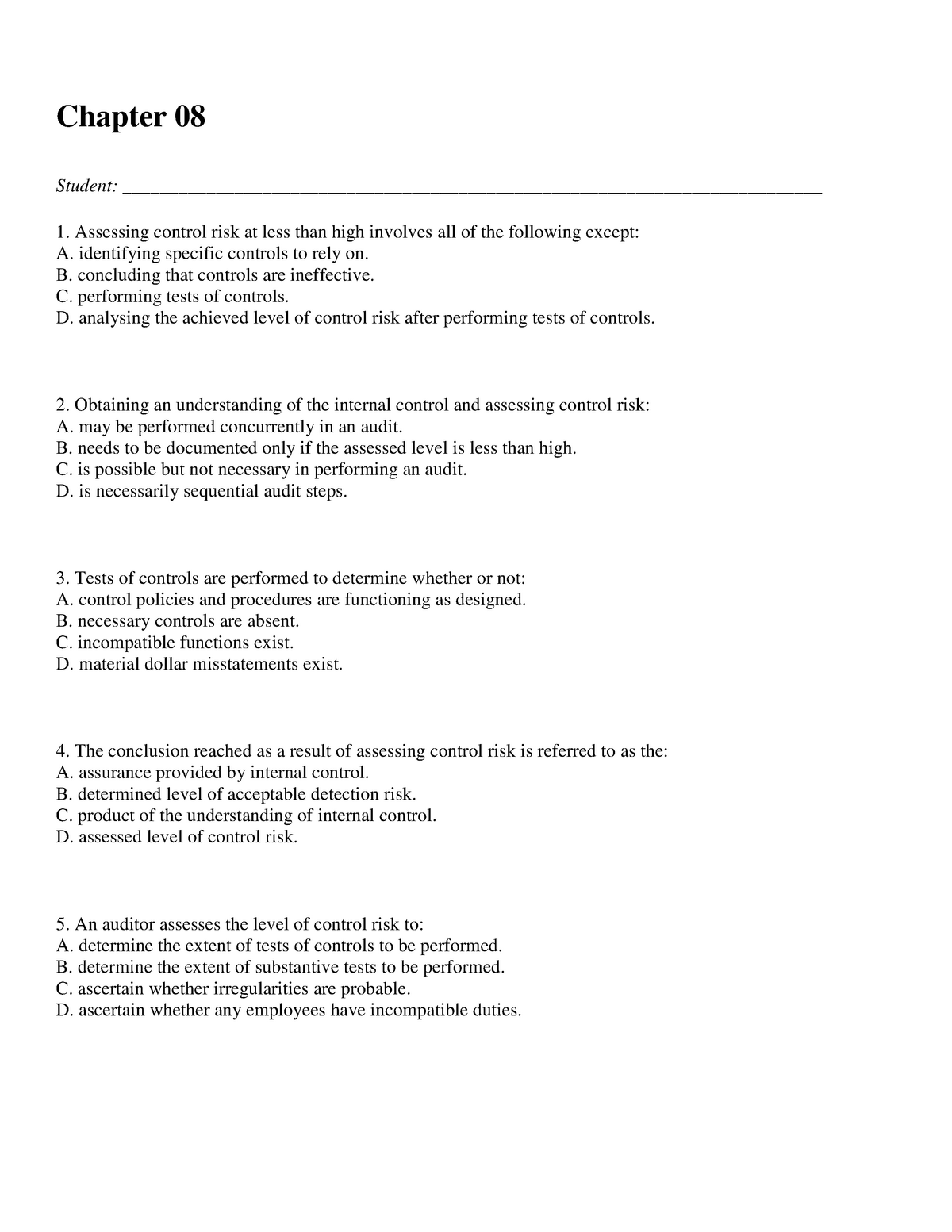

Choice d is correct. An auditor judged an item to be immaterial when planning an audit. Comparison of receiving reports and.

The governing body should review the income and expenditure against the budget at a meeting at least 3 times a year. EAuditNet is developed and maintained by PRI for the benefit of industries where safety and quality are shared values implementing a standardized approach to quality assurance. Coverage should include at a minimum a proof of records verification of assets reconciliation of any deposit and suspense accounts a review of the adequacy of internal controls and compliance with law.

If you want to follow or invest in a US. 2 Reviewing the financial and accounting aspects of the contractors cost control systems.

Health Resources and Services Administration.

Paragraphs 25 and 26 of this section describe the accountants consideration of such misstatements in a review of interim financial information. A The auditor is responsible for- 1 Submitting information and advice to the requesting activity based on the auditors analysis of the contractors financial and accounting records or other related data as to the acceptability of the contractors incurred and estimated costs. Sufficient staff is available. Scope We have examined Roll Pay Payroll Services Incs description of its systemfor. The auditor shall treat that item as a misstatement in the case of tests of details A. During every stage of the audit the auditor should consider the assessment of the risk of material misstatement. KPMG International Limited or simply KPMG is a British-Dutch multinational professional services network and one of the Big Four accounting organizations. Adverse effects related to the item are likely to occur. Headquartered in Amstelveen Netherlands although incorporated in the United Kingdom KPMG is a network of firms in 147 countries with over 227000 employees and has three lines of services.

EAuditNet is web-based software that supports and improves efficiency in the auditing and accreditation systems of industry managed programs administered by the Performance Review Institute. If the auditor identifies deficiencies in controls designed to prevent or detect fraud during the audit of internal control over financial reporting the auditor should take into account those deficiencies when developing his or her response to risks of material misstatement during the financial statement audit as provided in paragraphs 65-69. Paragraphs 25 and 26 of this section describe the accountants consideration of such misstatements in a review of interim financial information. Comparison of receiving reports and. Public company you can find a wealth of information in the companys annual reports on Form 10-K and quarterly reports on Form 10-QAmong other things the 10-K and 10-Q offer a detailed picture of a companys business the risks it faces and the operating and financial results for the fiscal year or quarter as applicable. A review of interim financial statements of a public company consists of analytical procedures and inquiries. Review the risk assessment at least once in a year on regular basis in addition to.

Post a Comment for "Which Item Is An Auditor Least Likely To Review During A System Controls Audit?"